SBI Credit Card Eligibility Criteria in India

- Minimum per month Income of Rs.18500 required in Metro cities

- Have a Bank Account in SBI, If looking for credit card on the basis of account.

- Photo copies of ID card, income proofs and address proof should be submitted.

- You should be an earning individual and should be above 21 year and less than 60 at the time of apply.

| Credit Card | Joining Fee | Annual Fee |

Doctor’s Credit Card Doctor’s Credit Card | Rs.1499 + GST | Rs.1499 + GST |

Simply Save Card Simply Save Card | Rs. 499 + GST | Nil |

Simply Click Card Simply Click Card | Rs. 499 + GST | Nil |

SBI FBB Style up Card SBI FBB Style up Card | Rs. 499 + GST | Rs. 499 + GST |

Air India SBI Signature Card Air India SBI Signature Card | Rs. 4999 + GST | Rs. 4999 + GST |

Yatra SBI Card Yatra SBI Card | Rs. 499 + GST | Rs. 499 + GST |

| SBI Platinum Credit Card | Rs. 2999 + GST | Rs. 2999 + GST |

| SBI Signature Credit Card | Rs. 4999 + GST | Rs. 4999 + GST |

| SBI Advantage Signature Card | Rs. 4999 + GST | Rs. 4999 + GST |

| SBI Advantage Platinum Card | Rs. 2999 + GST | Rs. 2999 + GST |

Latest sbi credit card offers July 2021

| Mobile EMI Offers | Special EMI offers on Vivo, Oppo, Amazon, MI, Univercell, Sangeetha, Big C, Spice Hotspot, Nokia, Ssamsung & Sony Phones |

| Gold GYM Offers | Take advantage of EMI option on your SBI Card EMI tenures: 3, 6, 9 and 12 month |

| Travel Offers | Special offers on thomas cook, Cleartrip, Make My Trip & yatra.com |

| EMI Offers on Insurance | EMI offers on Royal Sundaram, SBI Life, HDFC ERGO, Bajaj Allianz, Bharti AXA and Aviva Insurances. |

List of Available SBI Credit Card in India

SBI Lifestyle Credit Cards

SBI Card Elite

| Welcome e-Gift Voucher worth Rs. 5,000 on joining |

| Get free movie tickets worth Rs. 6,000 every year |

| Earn upto 50,000 Bonus Reward Points worth Rs. 12,500/year |

| Annual / Joining Fee: Rs.4999+ GST |

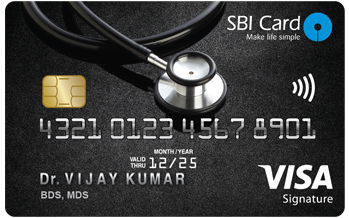

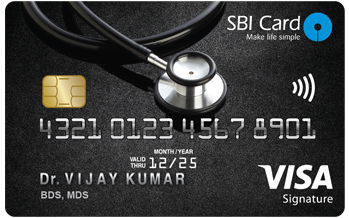

Doctor’s SBI Card (in association with IMA)

| Professional Indemnity Insurance cover of Rs. 20 Lakhs |

| e-Gift Voucher worth Rs. 1,500 on joining |

| 5X Reward Points on Medical Supplies, Travel Bookings, International Spends and Doctors’ Day |

| Annual Fee (one-time) : Rs. 1,499 |

SBI Card ELITE Advantage

| Welcome e-Gift Voucher worth Rs. 5,000 on joining |

| Get free movie tickets worth Rs. 6,000 every year |

| Earn upto 50,000 Bonus Reward Points worth Rs. 12,500/year |

| Annual / Joining Fee: Rs.4999+ GST |

Doctor’s SBI Card

| Professional Indemnity Insurance cover of Rs. 20 Lakhs |

| e-Gift Voucher worth Rs. 1,500 on joining |

| 5X Reward Points on Medical Supplies, Travel Bookings, International Spends and Doctors’ Day |

| Annual Fee (one-time) : Rs. 1,499 |

SBI Rewards Credit Card

SBI Card Prime

| Welcome e-Gift Voucher worth Rs. 3,000 on joining |

| Spend linked Gift Vouchers worth Rs. 11,000 |

| 10 Reward Points per Rs. 100 spent on Dining, Groceries, Departmental stores and Movies |

| Annual Fee (one-time):Rs. 2,999 + Taxes |

OLA Money SBI Card

| Earn 7% back on all Ola rides |

| Limited period offer: Earn additional 8% back on all Ola rides for the first year |

| Earn 1% back on all other Spends |

| Zero Annual Fee for the first year |

Apollo SBI Card

| Welcome benefit of 500 Reward Points worth Rs. 500 on payment of joining fee. |

| Complimentary OneApollo Silver Tier Membership. |

| Get Upto 10% Instant Discount at Select Apollo Services. |

| Joining fee, one time: Rs. 499 + GST |

SBI Card PRIME Advantage

| Welcome e-Gift Voucher worth Rs. 3,000 on joining |

| Spend linked Gift Vouchers worth Rs. 11,000 |

| 10 Reward Points per Rs. 100 spent on Dining, Groceries, Departmental stores and Movies |

| Annual Fee (one-time):Rs. 2,999 |

SBI Shopping Credit cards

Lifestyle Home Centre SBI Card PRIME

| 12,000 Reward Points as a Welcome benefit worth INR 3,000. |

| Enjoy 15 Reward Points on every 100 Rs. spent at Online & Retail Landmark Stores |

| Milestone benefits worth INR 14,500 annually |

| Annual fee :Rs. 2999 + Taxes |

Max SBI Card PRIME

| 12,000 Reward Points as a Welcome benefit worth INR 3,000. |

| Enjoy 15 Reward Points on every 100 Rs. spent at Online & Retail Landmark Stores |

| Milestone benefits worth INR 14,500 annually |

| Complimentary domestic & international lounge access |

| Annual fee :Rs. 2999 + Taxes |

Spar SBI Card PRIME

| 12,000 Reward Points as a Welcome benefit worth INR 3,000. |

| Enjoy 15 Reward Points on every 100 Rs. spent at Online & Retail Landmark Stores |

| Milestone benefits worth INR 14,500 annually |

| Annual fee :Rs. 2999 + Taxes |

Lifestyle Home Centre SBI Card SELECT

| 6,000 Reward Points as a Welcome benefit worth INR 1,500. |

| Enjoy 10 Reward Points on every 100 Rs. spent at Online & Retail Landmark Stores |

| Milestone benefits worth INR 8,600 annually |

| Annual fee :Rs. 1499 + Taxes |

Max SBI Card SELECT / Spar SBI Card Select

| 6,000 Reward Points as a Welcome benefit worth INR 1,500. |

| Enjoy 10 Reward Points on every 100 Rs. spent at Online & Retail Landmark Stores |

| Milestone benefits worth INR 8,600 annually |

| Annual fee :Rs. 1499 + Taxes |

Lifestyle HC SBI Card / MAX SBI Card / Spar SBI Card

| 2,000 Reward Points as a Welcome benefit worth INR 500. |

| Enjoy 5 Reward Points on every 100 Rs. spent at Online & Retail Landmark Stores |

| Milestone benefits worth INR 4,000 annually |

| Annual fee :Rs. 499 + Taxes |

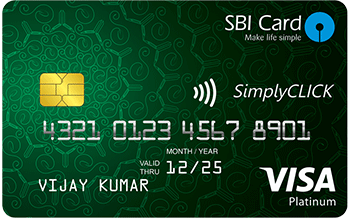

SimplyCLICK SBI Card

| Amazon.in Gift Card worth Rs. 500 on joining |

| 5X Reward Points on online spends |

| 10X Reward Points on online spends with exclusive partners |

| Annual fee :Rs. 499 + Taxes |

SimplySAVE SBI Card

| 2,000 bonus reward points on spends of Rs. 2,000 in first 60 days |

| Enjoy 10 Reward Points per Rs.100 spent on Dining, Movies, Departmental Stores and Grocery Spends |

| 1% fuel surcharge waiver across all petrol pumps |

| Annual fee :Rs. 499 + Taxes |

fbb SBI STYLEUP Card

| Flat 10% Discount on all Fashion Apparel, Accessories, Backpacks, Footwear & School Bags at fbbonline.in, fbb and Big Bazaar Stores |

| 10X Reward Points on Big Bazaar, fbb & Dining spend |

| Welcome gift of Rs. 500 worth fbb gift voucher |

| Annual fee :Rs. 499 + Taxes |

SBI Unnati Card

| SBI Card Unnati is free for first 4 years |

| Get 1 Reward Point per Rs.100 spent |

| Rs.500 cashback on annual spends of Rs.50,000 |

| 1% fuel surcharge waiver across all petrol pumps |

Simply CLICK Advantage SBI Card

| Amazon.in Gift Card worth Rs. 500 on joining |

| 5X Reward Points on online spends |

| 10X Reward Points on online spends with exclusive partners |

| Annual fee :Rs. 499 + Taxes |

Simply SAVE Advantage SBI Card

| Enjoy 10 Reward Points per Rs.100 spent on Dining, Movies, Departmental Stores and Grocery Spends |

| Annual fees reversal on spends of Rs. 1,00,000 and above |

| 1% fuel surcharge waiver across all petrol pumps |

| Annual fee :Rs. 499 + Taxes |

Shaurya SBI Card

| 5X Reward Points on CSD, Dining, Movies, Departmental Stores and Grocery spends |

| Waiver of Renewal Fee on annual spends of Rs. 50,000 or more |

| 1% Fuel Surcharge Waiver at all fuel stations across the country |

| Joining Fee: NIL, Renew Fee: Rs.250 + GST |

SBI Travel & Fuel Credit cards

Explore the world and enjoy exciting rewards and offers

IRCTC SBI Card Premier

| 10%* back as Reward Points for railway ticket purchases |

| Zero payment gateway charges on railway and Airline booking on irctc.co.in* |

| Milestone benefits worth INR 7500 on annual travel spends |

| Annual Fee (one-time): Rs.1499 + Taxes |

Club Vistara SBI Card PRIME

| Welcome Premium Economy ticket voucher for Vistara’s domestic network |

| Club Vistara Silver Tier Membership renewed every year |

| Up to 4 Premium Economy ticket vouchers & 1 Hotel Voucher worth Rs 10,000 on achieving milestone spends of Rs 8 lakhs |

| Annual Fee : Rs. 2999 + applicable taxes |

Etihad Guest SBI Premier Card

| 5,000 Etihad Guest Miles as Welcome Gift |

| Complimentary Etihad Guest Gold Tier Status post first transaction |

| Earn Upto 6000 Etihad Guest miles annually on quarterly spend of 1.5 lakh/quarter |

| Annual Fee (one-time) : Rs.4,999 + Taxes |

BPCL SBI Card

| 2,000 Activation Bonus Reward Points worth Rs.500 as a welcome gift. |

| 4.25% Value back – 13X Reward Points on every Rs.100 spent on fuel purchases. |

| 5X Reward Points on every Rs.100 spent at Groceries, Departmental stores, Movies, Dining & Utility bill |

| Joining Fee (one-time) :Rs. 499 |

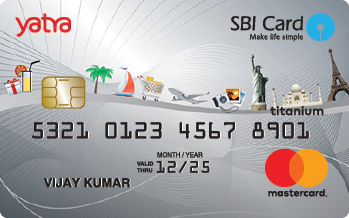

Yatra SBI Card

| Welcome Gift Vouchers worth Rs. 8250 |

| Rs. 1,000 Off *on Domestic Airfare / Rs. 4,000 Off* on International Flight Booking. |

| 20% Off* on Domestic Hotel Bookings |

| Annual Fee (one-time): Rs. 499 + applicable taxes |

Air India SBI Signature Card

| 20,000 Reward Points as Welcome Gift |

| Card Anniversary gift of 5,000 Reward Points every year |

| Upto 30 Reward Points for every Rs. 100 spent on Air India tickets. |

| Annual Fee (one-time) : Rs. 4,999 + Taxes |

IRCTC SBI Platinum Card

| Upto 10% value back as Reward Points for railway ticket purchases |

| 1.8% transaction charges waiver, on railway ticket bookings on irctc.co.in |

| 1% fuel surcharge waiver at all petrol pumps |

| Annual Fee (one-time):Rs. 500 + Taxes |

Chennai Metro SBI Card

| Dual usage Chennai Metro travel cum credit card |

| Get 2000 Bonus Cash Points on spends of Rs. 2000 in the first 60 days |

| 10 X Rewards on Dining, Movies, Departmental and Grocery spends |

| Annual Fee (one-time): Rs. 499 + applicable taxes |

How to Pay your SBI Credit Card Bills Online?

You can pay for sbi credit cards bills by over 12 different ways / Options– Utility bill payments, Via Paynet, Visa credit card pay, Electronic Clearing, Paycash, ATM, Locate & Pay, Auto Debit, Online through SBI, Mobile Banking, NEFT etc.

Pay SBI Credit Card Bills through YONO and Get Credit Limit Restored Instantly

For payment of sbi card through yono app, you have to first link your card and app, through few steps.

- Login to YONO by SBI App using MPIN or SBI Internet banking credentials.

- Click on ‘Link SBI Credit Card’, Enter Udername & password same as sbicard.in

- Enter OTP password and Its done.

How you can make a payment of SBI credit card through YONO APP?

Follow same steps till login on yono app by using sbicard.in login credentials.

- Choose Credit Card

- Select “Pay Now” and Pay the bill by using SBI account

How to Check SBI Credit Card Status / Application Status Online

Have you already applied for sbi card? Looking for application status? You can track your application in two ways:

- Check the status of your application via application number.

- Retrieve application via Date of birth & PAN Card number.

Note*:

Application number is 10 Digits long and started from R0000******

SBI credit card statement details

SBI Card statements are sent to you via bank on your e-mail ID and at your home/office address as per your choice. You can also join SBI Card Online via creating new account. In this account you get all of your card related information like – Statement, Billed statement, unbilled transactions, flexipay emi options, reward points etc. you can create a account @ https://www.sbicard.com/creditcards/app/user/login

SBI credit card reward points details

Redeem your earned reward points via visit (https://www.sbicard.com/en/personal/rewards.page), you can choose above 174+ products from the sbi card website or Category wise like Accessories, Apparel, Electronics, entertainment, E-voucher, health & fitness, Homeware, Kids Zone, Luxury and Travel & holiday.

How to Redeem SBI Reward Points – Check Here

About SBI Card

SBI Cards is a joint venture between State Bank of India, country’s oldest and largest bank and GE Capital. The partnership is operated through 2 joint-venture companies – SBI Cards & Payment Services Pvt. Ltd., focusing on the marketing and distribution of SBI Cards and GE Capital Business Processes Management Services Pvt. Ltd., which handles the technology and processing needs of SBI Cards. State Bank of India is currently one of the best card issuers in India with a base of over 2.7 million customers and offices in 63 cities.

SBI Card offers you a card for every need – Premium Cards, Travel & Shopping Cards, Classic Cards and Exclusive Cards & Corporate Cards along with Value added Services, Utility Bill Payment, Card Payment Options, and Offers & Rewards thereby, offering Indian consumers an extensive access to a wide range of world-class credit cards. Apply for a new SBI Credit Card now and Make Life Simple.

Disclaimer: The information displayed on this website is taken from sbicard.com. The information doesnt imply that we are associated with sbicard. No warranty, and expressly disclaims any obligation, that: (a) the content will be up-to-date, complete, comprehensive, accurate or applicable to your circumstances; (b) The Website will meet your requirements or will be available on an uninterrupted, timely, secure, or error-free basis; (c) the results that may be obtained from the use of the Website or any services offered through the site will be accurate or reliable; or (d) the quality of any products, services, information, or other material obtained by you through the site will meet your expectations.

SBI credit card customer care / Toll Free Number

You can contact SBI Card tollfree in case of any query or feedback, card lost or stolen cases at below provided numbers of SBI Card.

From BSNL/MTNL Lines – 1800-425-3800

From All Other Lines 080-26599990

Latest News on SBI Credit Card

SBI virtual card

– State Bank of India (SBI) offers virtual card which is a limit debit card.

SBI virtual card can be created for any amount in round rupees and used at any online merchant site that accepts debit, credit cards. These cards are valid up to 48 hours or until the transaction is complete.

SBI virtual card hides the primary card and account details from the merchantThe minimum transaction amount to create an SBI virtual card is Rs 100 and the maximum is Rs 50,000SBI virtual card creation and online transaction is authorised after successful validation of OTP sent to the registered mobile numberWant a loan against credit card? See what SBI are offering

Currently many banks and fintechs are offering insta loan services and here, a credit card is a big help. Special offers in credit cards

- SBI’s Encash – minimum booking amount for Encash is Rs 10,000, which may vary in case of specific offers. The maximum booking amount is based on the offer on your account.

- Processing fee of 2% of the Encash amount (minimum of Rs 499 up to a maximum of Rs 3,000)

- You can book Encash for a period of 12, 24, 36 or 48 months. The available tenures may vary with respect to time and offers.

Doctor’s Credit Card

Doctor’s Credit Card Simply Save Card

Simply Save Card Simply Click Card

Simply Click Card SBI FBB Style up Card

SBI FBB Style up Card Air India SBI Signature Card

Air India SBI Signature Card Yatra SBI Card

Yatra SBI Card