Usually, customers take a credit card from the bank for online shopping, it is a type of loan which you have to repay to the bank after shopping. Although it is very difficult for common people to take a credit card card from any bank, but if you do any government or private job, then banks provide the card to you very easily. If you are thinking of taking a credit card from a bank or you already have this card, then you must know about the advantages and disadvantages of credit card. Because having this information, you can use the credit card properly. If we talk about SBI Bank, then getting a card of this bank is a bit difficult because this government bank takes details from your job to your monthly salary. If you do not do a job then it is very difficult for you to get a credit card of SBI Bank.

At the same time, it is a little easier to take a credit card from a private bank. Now the question arises that when do we need to take a credit card, then when we do online shopping, there is an option to pay with credit card, if you pay with credit card then you will get some percent discount in shopping. is. Apart from this, there are many international websites where only credit card payment option is available. In such a situation, you also need to take a credit card to make payment in the international website. Here we are going to tell you the Advantages and Disadvantages of Credit Card , so that you can know the credit card better. Although there are advantages to taking a credit card, but it also has some disadvantages which you must know.

If you have a credit card, then you must know that whatever purchases you make with the credit card does not affect the amount of your bank account, that means whatever shopping you do with the credit card, the money will not be deducted from your account. However, later you have to pay this amount along with interest to the bank. The biggest advantage of a credit card is that you can do any number of shopping at any time within the limit of your card. This is what makes a credit card different from a debit card. Whatever shopping you do inside the debit card is immediately deducted from your account. Credit cards also have some disadvantages like interest plays an important role in it. So let's know what are the Advantages and Disadvantages of Credit Cards.

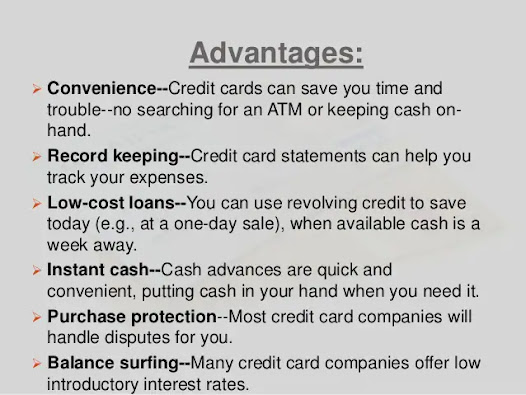

Advantages of Credit Card

1. With this card, a person can make purchases i.e. online shopping more than the amount deposited in his account. It has nothing to do with the amount in your account.

2. Helps to build your credit score means if you pay this card amount on time then your credit score gets better. This increases your chances of getting a quick loan from the bank.

3. If you shop with this card then you get reward points and cashback. Although these are few but the more you shop with this card, the more reward points and cashback increases. You can use these reward points for further shopping.

4. There is no chance of fraud in this card, but if you are cheated under shopping with this card and fraud is proved, then the bank will not charge you for it.

5. Many credit cards do not have an annual charge, meaning you do not have to pay any fee for this card every year.

6. With a credit card, you can take any item on installments i.e. on EMI. The EMI amount will be automatically deducted from your credit card.

7. At the end of every month, you get a statement on which information about when, how much and where you have shopped, this makes it easy for you to make a budget.

Disadvantages of Credit Card

1. There are many such hidden charges and fees in this card, which most people are not aware of. The bank also does not tell you about these, so the bill you get includes hidden charges and fees.

2. If you make late payment for shopping done with credit card, then the bank charges you a separate fee under late payment which is very high. Apart from this, the more time you spend in making the payment, the bank recovers its money from you along with interest.

3. With this, whenever you make a payment in the international website, the bank does not keep its information because the bank only keeps the payment made in the country under its supervision. In such a situation, there is a possibility of fraud in this card from the international website.

4. For shopping more than the limit, additional fees are added to the bill. Suppose your credit card limit is 50 thousand and you shop for more than 50 thousand, then the bank adds its additional charge along with interest to your bill.

5. If we do not pay the credit card bill on time, then daily interest is charged on the amount of the bill and this interest increases day by day. For example, if your one month bill is 20 thousand, which you have not paid, then interest will continue to be charged on this 20 thousand amount every day.

6. So now you must have come to know about the advantages and disadvantages of credit cards, if you keep paying the bills from this card on time, then your credit score remains correct. In such a situation, you can also apply for a loan from the bank if needed. Considering your credit score, you are likely to get a quick loan. So if you have a credit card and you want to avoid extra charges, then you should keep paying the bill on time.